In the high-stakes world of venture investing, even seasoned investors like Kevin O’Leary from “Shark Tank” can face significant setbacks. A recent calamity saw O’Leary lose $16 million in an investment turned sour, tied to the notorious collapse of FTX, a cryptocurrency exchange that imploded in a scandal costing billions.

A Promising Start Ends in Financial Ruin

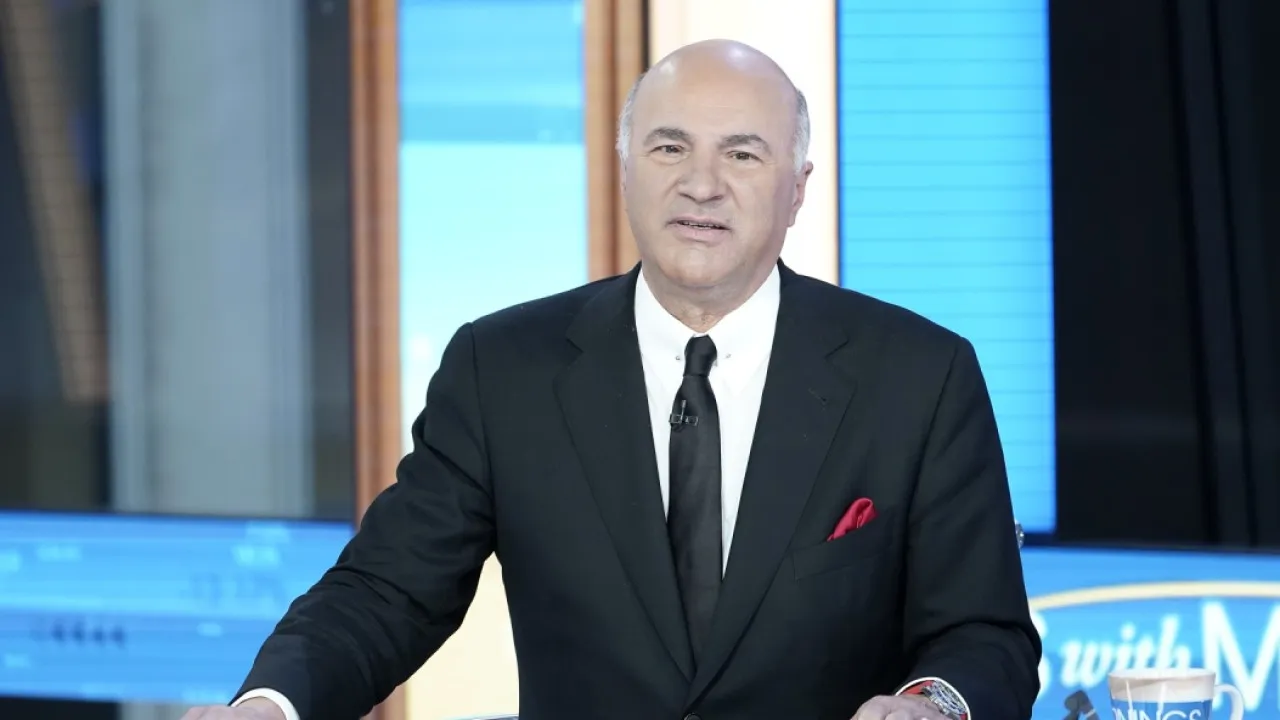

Kevin O’Leary is renowned for his sharp business acumen and his knack for identifying lucrative opportunities. His investment strategy often involves promoting promising platforms, and FTX was no exception. Initially celebrated as a robust platform for trading digital currencies, FTX looked like a gold mine. O’Leary himself was enticed into promoting the exchange, a decision that initially came with a hefty $16 million payment. However, the situation took a dire turn as FTX faced a catastrophic downfall. Speaking at a Harvard event, O’Leary shared his bitter experience: “He [Sam Bankman-Fried] paid me $16 million on the FTX exchange, and I was wiped out … But what I said [to CNBC] was I’m a venture investor. Eight out of 10 deals I do go to zero for various reasons: market changes, execution excellence not there, sometimes fraud, which is being alleged here and … being tried this week as we sit here.”

The Collapse of a Crypto Giant

The FTX scandal not only affected O’Leary but also shook the global cryptocurrency market, highlighting the risks and volatility associated with digital currencies. The exchange’s failure, precipitated by fraudulent activities and reckless management, led to a staggering loss of $8 billion of customer funds. Despite efforts to recuperate losses, with FTX managing to recover nearly $16 billion for creditor reimbursement, the company announced its inevitable shutdown. This episode serves as a stark reminder of the inherent risks in the crypto sector, raising doubts about security and investor protection. It underscores the importance of due diligence and the unpredictable nature of high-gain ventures.

Lessons in Resilience and Risk

Despite the harsh outcomes, O’Leary’s perspective remains focused on learning and resilience. At the same Harvard event, he encouraged aspiring entrepreneurs to embrace failure as a stepping stone to greater success. “Failure is common and should not stop people from trying.” He highlighted that such setbacks are essential for learning and future decision-making. This ethos reflects O’Leary’s broader investment philosophy: to invest in companies that address significant challenges. His rationale is that businesses that solve critical problems, like renewable energy or cybersecurity, are not only beneficial for society but also present substantial opportunities for growth and profitability.

Navigating the Future of Investment

The FTX debacle, while a significant blow, hasn’t deterred O’Leary from his pursuit of investing in problem-solving ventures. His strategy focuses on companies poised to make a meaningful impact, suggesting a path forward for investors seeking to merge profitability with positive change in the world.

As the dust settles on the FTX scandal, the narrative isn’t just about a lost $16 million; it’s a broader discourse on the lessons learned from investment failures and the continuous search for opportunities that offer both challenges and substantial rewards. This saga serves as a compelling chapter in the ever-evolving story of venture capitalism, reminding us that the road to success is often paved with unexpected hurdles.