In the ever-volatile world of cryptocurrency and digital assets, the NFT (Non-Fungible Token) craze that captured global attention in 2022 has seen its fair share of dramatic downturns. Amidst this tumultuous market, numerous high-profile celebrities have watched their investments plummet, none more publicly than comedy superstar Kevin Hart and pop culture icons Justin Bieber and Madonna.

Kevin Hart’s Costly Digital Adventure

Kevin Hart, known for his roles in blockbusters like “Jumanji,” made headlines with his foray into the NFT market, specifically with his investment in the Bored Ape Yacht Club, a collection of digital art pieces traded as NFTs. Hart’s venture turned sour as he reportedly incurred a staggering loss. Initially purchasing his Bored Ape for a hefty $200K, aided by the cryptocurrency payment service MoonPay, Hart later sold the digital asset for just 13.26 ETH—equivalent to about $46K at the time of the sale. This marked a significant financial hit, nearly $150K in losses, highlighting the risks associated with the fluctuating values of digital assets.

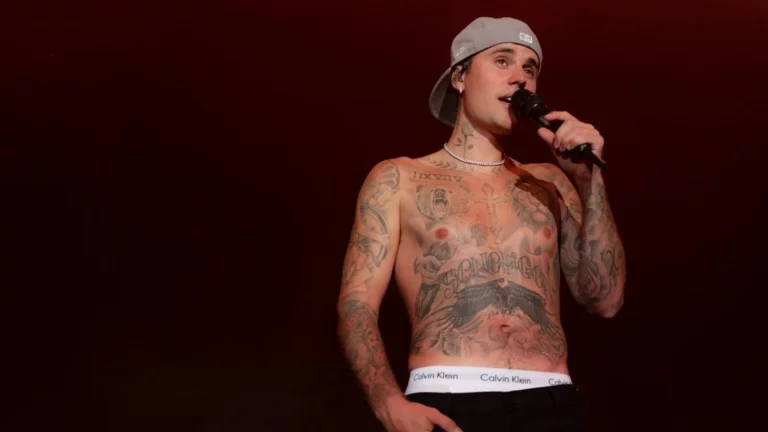

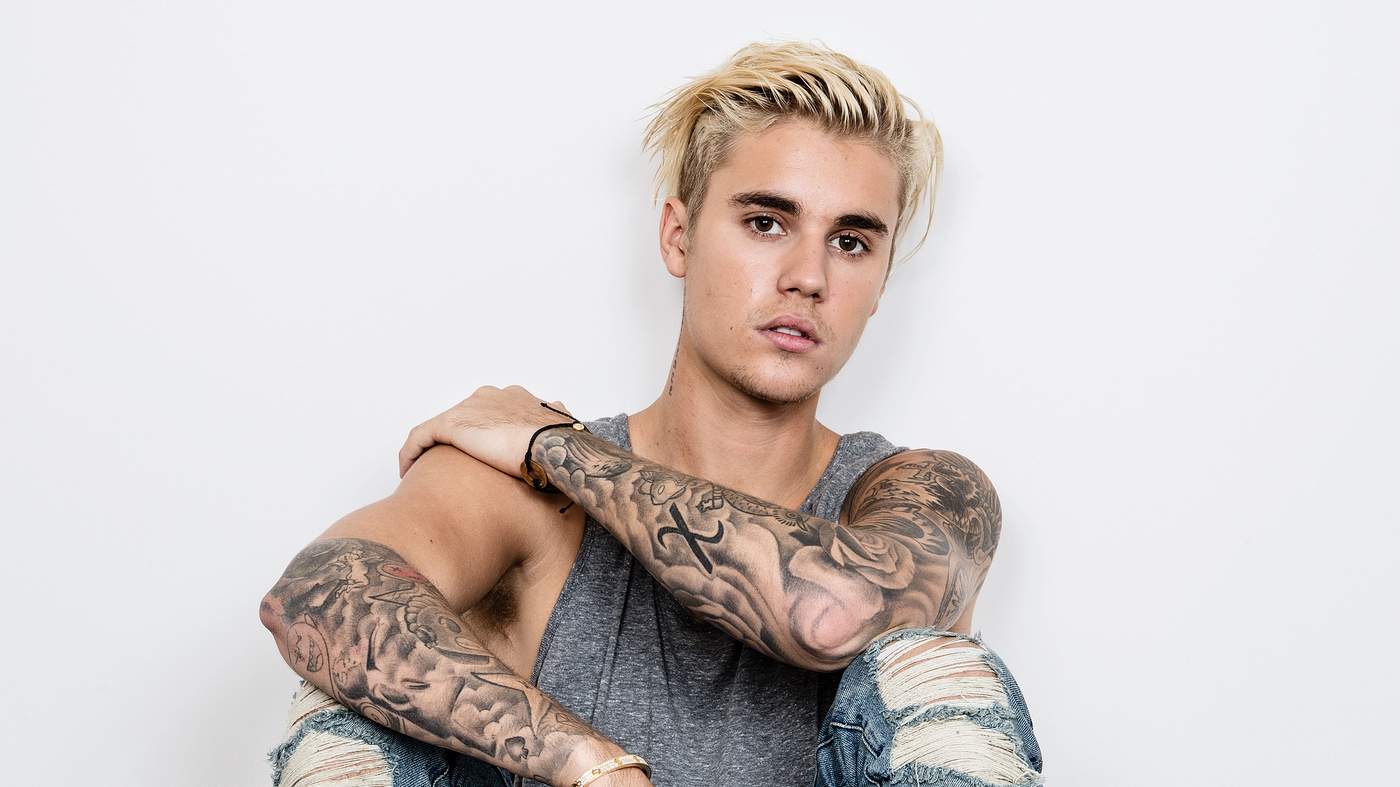

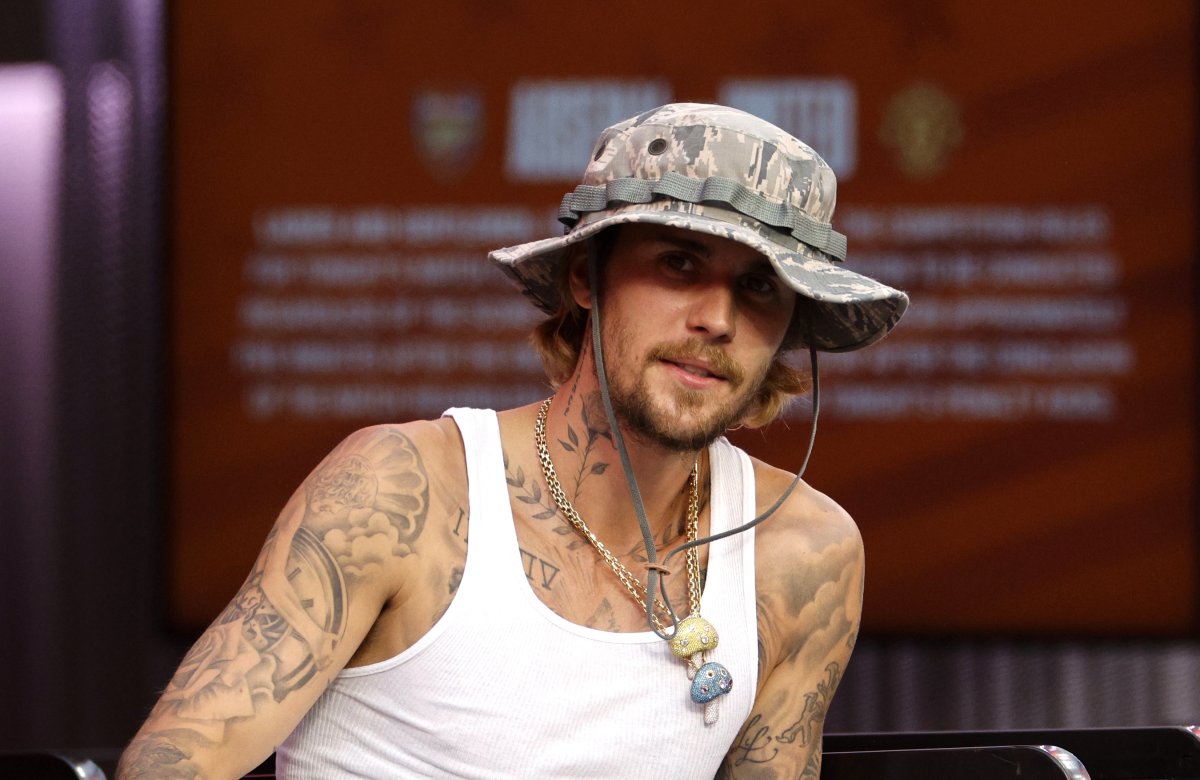

The Steeper Declines of Justin Bieber and Madonna

While Hart’s losses were substantial, they were dwarfed by the financial downturns experienced by Justin Bieber and Madonna. Both artists made significant investments into the Bored Ape Yacht Club during the peak of NFT mania. Bieber, for instance, acquired his Bored Ape for 500 ETH, roughly translating to $1.3 million, only to see its value diminish to a mere $59K—a loss approaching $1.2 million. Similarly, Madonna purchased her NFT for 180 ETH (valued at $466K) and watched its worth decline to 28 ETH, or just over $53,000, resulting in a loss of over $400K.

A Market in Decline: A Study by DappGambl

The rapid devaluation of NFTs is not isolated to celebrities alone. A comprehensive study by DappGambl highlighted the broader market trends where a staggering 95% of NFT collections analyzed now hold a market cap of zero ETH.

“Of the 73,257 NFT collections we identified, an eye-watering 69,795 of them have a market cap of 0 Ether (ETH). This statistic effectively means that 95% of people holding NFT collections are currently holding onto worthless investments. Having looked into those figures, we would estimate that 95% to include over 23 million people whose investments are now worthless.”

Legal Troubles Amidst Market Chaos

Adding to their financial woes, Hart, Bieber, and Madonna were also named in a class-action lawsuit filed by investors of Yuga Labs, the creators of Bored Ape Yacht Club. The lawsuit claims that the celebrity endorsements of the NFTs were misleading, promising high returns on investments that have largely failed to materialize, thus exacerbating the financial damages incurred by countless investors.

The NFT boom and subsequent bust serve as a cautionary tale about the unpredictable nature of digital investments. While the allure of quick profits and being part of a new technological wave is tempting, the experiences of celebrities like Kevin Hart, Justin Bieber, and Madonna underscore the potential for significant financial loss. As the market continues to stabilize and evolve, both investors and celebrities are becoming more circumspect about where and how they allocate their resources in digital assets, aiming to avoid the pitfalls that have beset many within this high-stakes digital arena.